Tax accounting is a specialized field of accounting that focuses on tax-related financial reporting, compliance, and planning. Tax accountants use their expertise in tax laws and regulations to help individuals and businesses meet their tax obligations while minimizing their tax liability.

Work description

A tax accountant’s work involves :

- preparing tax returns

- conducting tax research

- advising clients on tax-related matters ensuring compliance with tax laws and regulations.

Tax accountants must stay up-to-date with the latest tax laws and regulations, and they must be able to communicate complex tax concepts to clients in a way that is easy to understand.

High Demand

Good job security: Tax accountants are in high demand all year round, especially during tax season.

Lucrative salaries

High earning potential: Tax accountants can earn a competitive salary and may have the opportunity for bonuses.

Opportunities for innovation

Room for advancement: Tax accounting offers many opportunities for career growth, including management positions, partnerships, or starting your own practice.

Versatility

Variety of work: Tax accountants work with a wide range of clients from individuals to large corporations. This provides a diverse and challenging work experience.

High stress

Long hours: During tax season, tax accountants may have to work long hours, including weekends and evenings.

Long hours

Detail-oriented work: Tax accounting requires a high level of attention to detail and accuracy, which may not be suitable for everyone.

Competitive field

Monotonous work: The work can become repetitive, especially when working with the same clients each year.

Constant learning

Constantly changing regulations: Tax laws and regulations change frequently, so tax accountants need to stay up to date with the latest changes.

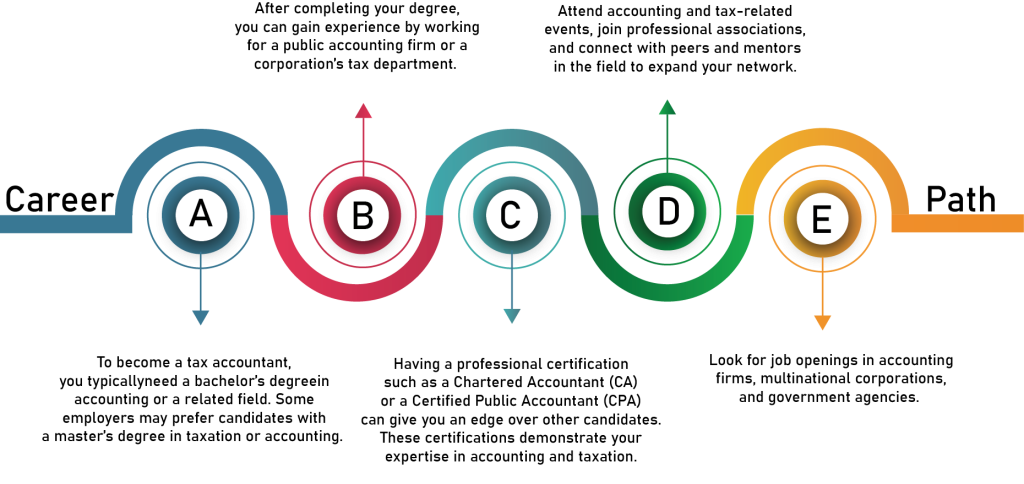

The investment required to become a tax accountant includes obtaining a degree, obtaining a CPA license, and obtaining experience. These investments can vary in cost depending on the institution and location.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

The earning potential for tax accountants in India varies depending on their level of experience, the industry they work in, and their specialization. The average salary for a tax accountant in India is INR 4-5 lakhs per year.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Attention to detail

Analytical skills

Good communication skills

Ability to work under pressure

Bored of doing monotonous work

Having Limited creativity

Lack of detail-orientedness

Lacking in patience

Inadequate communication abilities

Work-life balance

Due to the nature of the work, keeping a healthy work-life balance can be difficult for tax accountants. Tax accountants have a busy season when they put in long hours and work with deadlines. To prevent burnout and maintain general wellbeing, it is crucial to maintain a balance between work and personal life.

Tax accountants can prioritize their workload and establish attainable goals to create a work-life balance. To control expectations, they can also let their bosses and clients know what they need. To unwind and recharge, tax accountants can take frequent breaks, work out frequently, and spend time with their loved ones.

Artificial Intelligence Machine Learning

Involves developing algorithms that enable machines to learn from data and make decisions without human intervention.

Cyber security

Focuses on protecting computer systems, networks, and sensitive data from unauthorized access, attacks, and theft.

Software Engineering

Involves designing, developing, and maintaining software applications and systems.

Data Science Machine Learning

Involves processing, analyzing, and interpreting large and complex data sets using statistical and computational methods.

Computer Networks

Focuses on designing, implementing, and maintaining computer networks that enable communication and data transfer between devices.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.