Retail banking is a branch of banking that deals with providing financial services and products to individual customers, rather than large corporations or institutions. It involves activities such as deposits, loans, credit cards, and other financial services that are targeted towards individual customers. Retail banking is a highly competitive and rapidly evolving field, driven by technological advancements and changing customer needs.

Work description

The work in retail banking typically involves

- serving customers

- processing transactions

- promoting financial products

- providing financial advice

The specific duties and responsibilities vary depending on the role and level of seniority.

Stable career path

High demand for retail banking services, which creates ample job opportunities.

Competitive salary

Potential for high earnings, especially for top performers in sales and management roles.

Opportunities for growth

Opportunity to build long-term relationships with customers and help them achieve their financial goals.

Transferable skills

Opportunities for career growth and advancement within the industry.

high demand

Computer engineers may have the option to work remotely or on a flexible schedule, depending on the job and employer

Job satisfaction

The need for financial accounting is not limited to any specific industry, so there is always a high demand for qualified professionals.

High stress

Intense competition for jobs, especially in highly desirable locations or with top-tier banks.

Long hours

High-pressure work environment, especially in sales roles that require meeting aggressive targets.

Details oriented

Possibility of long working hours and a demanding schedule.

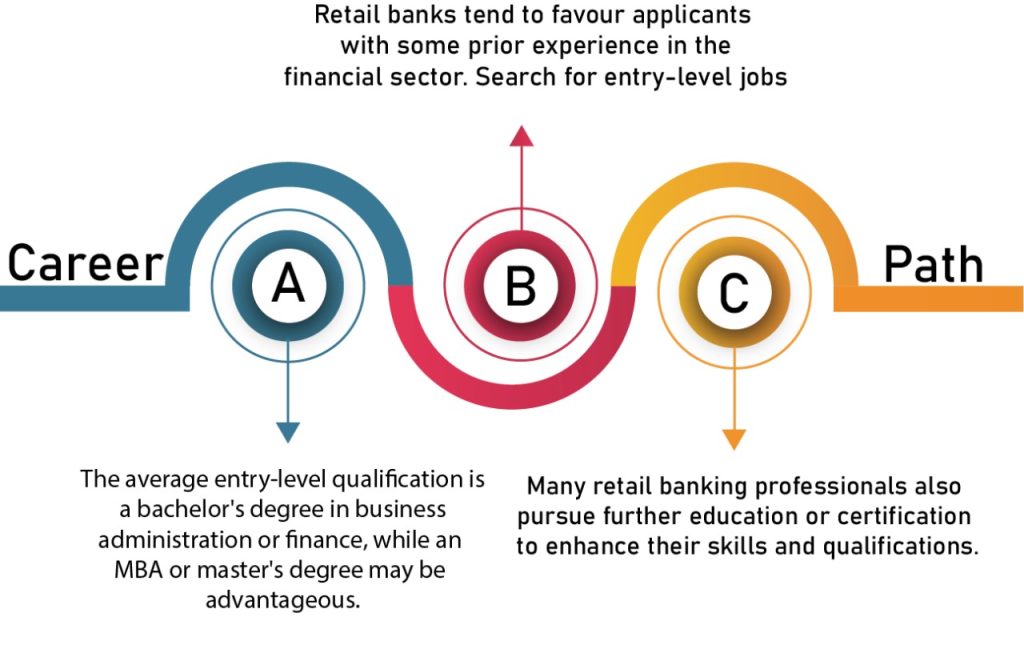

The investment required to enter the retail banking industry in India is relatively low compared to other fields, as most entry-level positions require only a high school diploma or equivalent.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

However, the earning potential in retail banking can be quite high, with the potential for significant commissions and bonuses for top performers in sales and management roles.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Strong communication skills

Willingness to learn and adapt

Attention to detail

A positive attitude.

Good communication and teamwork skills

lack of initiative

poor time management skills

inability to work collaboratively with others.

Poor communication or teamwork skills.

Impatience or inability to work through complex problems.

Tendency to procrastinate or miss deadlines.

Work-life balance

Achieving a good work-life balance is essential for leading a healthy, fulfilling life. This means finding a way to balance your personal and professional responsibilities so that you have time and energy for both.

To achieve this balance, it’s important to set clear boundaries between work and personal time, prioritize your tasks, and learn to say no when necessary.

Additionally, incorporating hobbies, exercise, and relaxation into your daily routine can help reduce stress and improve your overall well-being.

The economy of a nation can be significantly impacted by a career in retail banking. It can support economic expansion, financial stability, and the development of new jobs.

Consumers and businesses can benefit from the basic services that retail banks offer, such as credit cards, loans, and deposit accounts, from which they can better manage their finances.

Together with the ability to make a decent living, employment in retail banking can provide prospects for professional advancement.

A robust retail banking industry may support a nation’s financial infrastructure, advance financial literacy, and improve the general welfare of its populace.

The increasing reliance on technology has led to concerns about privacy and security, leading to the need for stronger regulations and cybersecurity measures.

The development of automation and artificial intelligence may lead to job displacement and require reskilling for certain sectors.

Personal banking

It involves working with individual customers to provide banking services such as opening accounts, managing deposits and withdrawals, and offering financial advice.

Credit analysis

It involves evaluating the creditworthiness of individuals and businesses to determine their eligibility for loans and credit lines.

Risk management

It involves identifying and mitigating potential risks to the bank, such as credit risk, market risk, and operational risk.

Compliance Science

It involves ensuring that the bank is in compliance with relevant laws and regulations, as well as developing and implementing policies to mitigate risk and prevent fraud.

Computer Networks

Focuses on designing, implementing, and maintaining computer networks that enable communication and data transfer between devices.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.