Corporate finance is a dynamic and challenging field that involves managing a company’s financial activities and investments to maximize shareholder value. As a career option, it offers excellent opportunities to work in a variety of industries and roles, such as financial analysis, investment banking, and treasury management. With the growing complexity of global financial markets, corporate finance professionals are in high demand, and the field offers competitive salaries and career growth prospects.

Work description

The work in corporate finance can vary depending on the company and the role. Some common tasks include financial analysis, forecasting and budgeting, capital budgeting, risk management, and investor relations. Corporate finance professionals must also stay up-to-date on industry trends and regulations to ensure that their strategies are relevant and effective.

High salary potential

A career in corporate finance can offer high earning potential, especially for those who work their way up to senior management positions.

Job security

Companies rely on financial professionals to manage their finances and make important financial decisions, so there will always be a need for people with finance expertise.

Opportunities for advancement

Many companies have a hierarchical structure, which means there are often opportunities for advancement and career progression within the finance department.

Varied work

Corporate finance roles can involve a wide range of tasks, from financial analysis to forecasting and budgeting. This variety can make the work interesting and engaging.

Transferable skills

Many of the skills developed in a corporate finance career, such as financial analysis and decision-making, are highly transferable to other industries and roles.

Job satisfaction

The need for financial accounting is not limited to any specific industry, so there is always a high demand for qualified professionals.

Long Working Hours Hours

Corporate finance professionals often work long hours, especially during peak periods, such as financial reporting seasons

High-pressure environment

The finance department is often under pressure to deliver accurate and timely financial information, which can be stressful for those working in the department.

Tight deadlines

Financial reports and analysis often have strict deadlines, which means that finance professionals may have to work under tight time constraints.

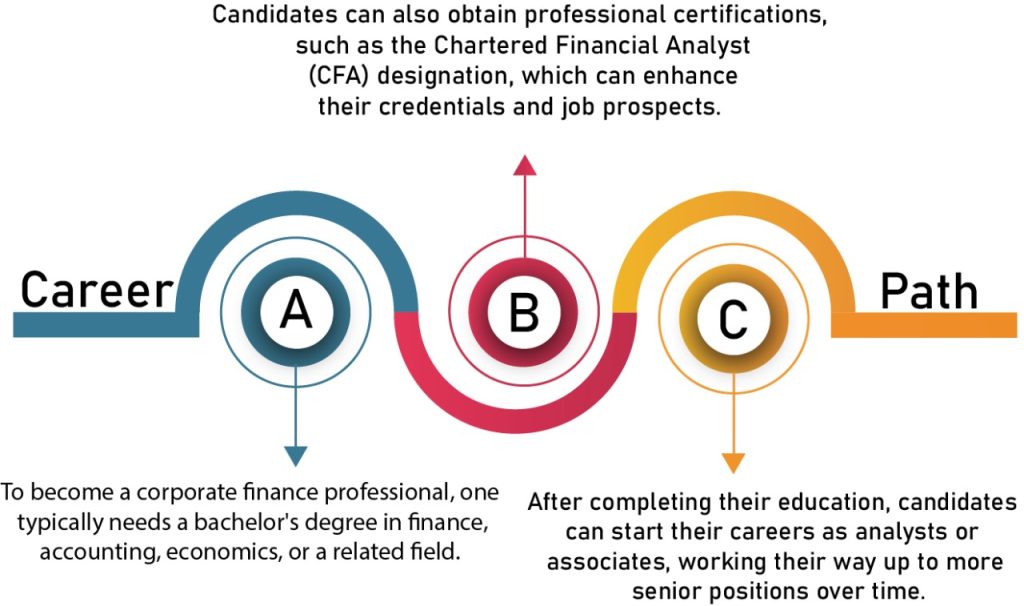

A career in corporate finance can provide a lucrative earning potential and opportunities for investment. Individuals in this field can earn high salaries and bonuses as they climb the corporate ladder and take on leadership roles. Additionally, many companies offer stock options, retirement plans, and other investment opportunities as part of their compensation packages.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

However, the level of investment required to succeed in this field can also be high, with many professionals pursuing advanced degrees and certifications such as an MBA or CFA. It’s important to carefully weigh the potential return on investment and personal career goals before pursuing a career in corporate finance.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Must be able to interpret financial data and draw insights

Have excellent communication skills

Should be able to collaborate effectively with team members and build strong working relationships.

Should be able to collaborate effectively with team members and build strong working relationships.

Must be adaptable and able to work in a fast-paced environment.

Not being detail-oriented may make it difficult to keep track of all the information which could lead to expensive mistakes.

Poor effective communication skills.

Lack of business acumen makes it difficult to make informed decisions and develop effective strategies.

Not adaptable or flexible may struggle to keep up with new trends, regulations, and technologies.

Impatience or inability to work through complex problems.

Tendency to procrastinate or miss deadlines.

Work-life balance

Corporate finance can be demanding, with long working hours and tight deadlines.

But it’s important to remember that personal lives are just as important as professional ones.

Taking breaks, exercising, spending time with loved ones, and pursuing hobbies can all help maintain a healthy work-life balance. It’s essential to set boundaries and prioritize self-care to avoid burnout and ensure sustainable success. Additionally, as professionals progress in their careers, one may have more control over their schedules and workloads.

Corporate finance plays a crucial role in driving economic growth and development in a country.

By helping companies make strategic investment decisions, manage financial risks, and raise capital, corporate finance professionals can contribute to job creation, innovation, and overall economic prosperity.

The increasing demand for computer engineers has led to job creation and economic growth in various countries, including India.

Computer engineering has enabled advancements in fields such as healthcare, education, and communication, leading to better access to services and resources.

The increasing reliance on technology has led to concerns about privacy and security, leading to the need for stronger regulations and cybersecurity measures.

The development of automation and artificial intelligence may lead to job displacement and require reskilling for certain sectors.

Financial Planning and Analysis (FP&A)

It involves forecasting, budgeting, and analyzing financial information to help the company make strategic decisions.

Treasury Management

It involves managing a company’s cash flow, investments, and financial risk.

Corporate Development

It involves identifying and executing on growth opportunities, such as mergers and acquisitions, joint ventures, and strategic partnerships.

Financial Reporting and Analysis

It involves preparing and analyzing financial statements, as well as ensuring compliance with accounting standards and regulations

Capital Markets

It involves raising capital for companies through debt or equity financing, as well as managing a company’s relationships with investors and lenders.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.