Banking is a promising career option for those interested in finance and commerce. Banks play a crucial role in the economy by providing financial services, managing money, and promoting economic growth. A career in banking offers excellent growth opportunities and a chance to work in a dynamic and challenging environment. It also offers a competitive salary package, job security, and opportunities for career advancement. As the banking sector continues to evolve, it presents new opportunities for those who are interested in pursuing a career in this field.

Work description

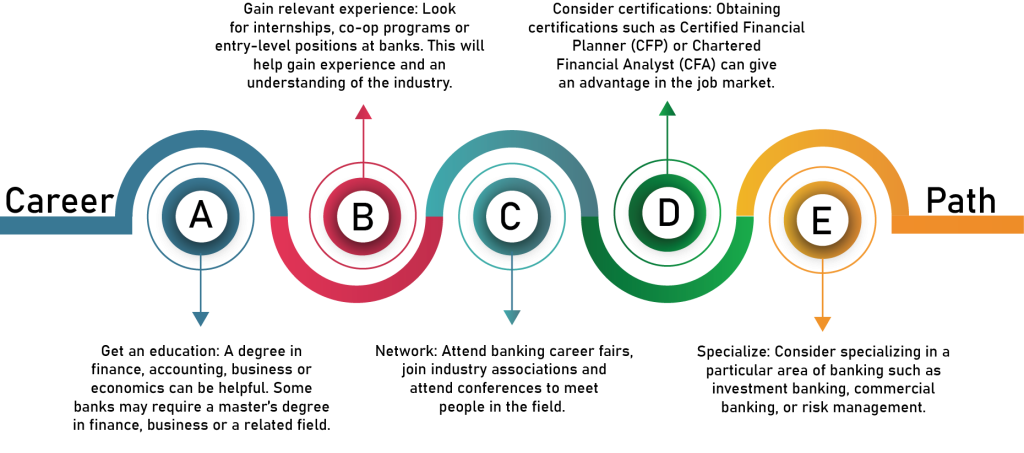

If you’re interested in pursuing a career in banking, here are the steps you need to take:

- Get an education: A degree in finance, accounting, business or economics can be helpful. Some banks may require a master’s degree in finance, business or a related field.

- Gain relevant experience: Look for internships, co-op programs or entry-level positions at banks. This will help gain experience and an understanding of the industry.

- Network: Attend banking career fairs, join industry associations and attend conferences to meet people in the field.

- Consider certifications: Obtaining certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) can give an advantage in the job market.

- Specialize: Consider specializing in a particular area of banking such as investment banking, commercial banking, or risk management.

- Apply for jobs: Once you’ve gained the relevant education, experience, and certifications, start applying for banking jobs that fit your interests and skill set.

- Keep learning: Stay up-to-date with industry trends and regulations by attending conferences, taking courses, and reading industry publications.

Remember that banking is a highly competitive industry, so be prepared to work hard and continually develop your skills and knowledge to succeed. Good luck

Job Security

The banking industry is one of the most stable and secure industries in the world.

Career growth opportunities

There are plenty of opportunities for career growth within the banking industry, with promotions and advancement to higher positions.

Good compensation

Banking jobs typically offer good salaries and benefits packages.

Exposure to diverse fields:

Banks offer services in various fields, such as investment banking, retail banking, corporate banking, and wealth management, which can provide employees with exposure to different fields.

Long working hour

Banks typically operate during standard business hours, but many banking jobs require long working hours and even weekend work.

High pressure

Computer engineers may be required to work long hours, especially during critical project phases or when troubleshooting issues.

High competition

The banking industry is highly competitive, and getting into the industry can be challenging.

In terms of investment, a career in banking typically requires a significant amount of education and training, such as obtaining a degree in finance, economics, or a related field. In addition, many banks offer training programs for new hires to develop skills in areas such as financial analysis, risk management, and customer service. These programs can be time-consuming and require a significant investment of both time and money.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

On the other hand, the earning potential in banking can be quite high. The banking sector is one of the highest paying industries in India, with many entry-level positions offering competitive salaries. Additionally, those who advance to higher positions can earn even higher salaries and bonuses.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Strong problem-solving skills.

Attention to detail

Good communication and interpersonal skills

Ability to work well under pressure

Lack of honesty and integrity

Poor communication skills

Lack of teamwork and collaboration

Lack of financial acumen

Work-life balance

Work-life balance can be challenging in the banking industry due to long working hours and high-pressure environments. However, some banks have started to offer flexible working arrangements to improve work-life balance for their employees.

This includes offering flexible work arrangements such as remote work options, job sharing, and part-time work. Additionally, many banks provide wellness programs, gym memberships, and other resources to help their employees manage stress and maintain their health. Despite these efforts, work-life balance in banking can still be a challenge due to the high-pressure nature of the industry and the need to meet tight deadlines.

A career in banking can have a significant impact on the economy, as banks play a crucial role in facilitating financial transactions and providing financial services to individuals and businesses.

The banking industry in India has undergone significant changes in recent years, with the introduction of new technologies, regulations, and financial products.

The demand for banking professionals has increased significantly with the growth of the industry. The banking industry in India offers excellent career growth opportunities, job stability, and attractive remuneration packages.

Investment Banking Machine Learning

Focuses on advising and managing financial transactions for corporations and governments, including mergers and acquisitions, IPOs, and securities offerings.

Retail Banking

Focuses on providing financial services to individuals and small businesses, including savings and checking accounts, loans, and credit cards.

Corporate banking

Provides financial services and products to large corporations, including lending, cash management, and risk management.

Wealth managemen Machine Learning

Provides investment advice and financial planning services to high net worth individuals and families.

Risk Management

Focuses on identifying, assessing, and mitigating risks in the banking industry, including credit risk, market risk, and operational risk