Quantitative finance is a field that combines mathematical, statistical, and computational techniques to understand and analyze financial markets and instruments. It involves developing and implementing financial models and strategies using mathematical and statistical tools, including calculus, probability theory, and data analysis. Quantitative finance is a rapidly growing field, and it offers numerous career opportunities for individuals with strong analytical and quantitative skills.

Work description

The work of a quantitative finance professional typically involves developing and implementing financial models and strategies using mathematical and statistical tools. This may include

- analyzing market data to identify trends and opportunities

- developing risk management strategies

- creating financial products to meet the needs of clients.

Individuals in this field may work in a variety of settings, including banks, investment firms, and hedge funds.

High earning potential

quantitative finance professionals are often highly paid due to their specialized skills.

Challenging work

the work in quantitative finance requires advanced mathematical and analytical skills, making it intellectually stimulating.

Opportunities for growth

as a quantitative finance professional, you can develop expertise in a variety of areas, such as risk management, trading, and portfolio management, which can lead to career advancement opportunities.

Global opportunities

quantitative finance is a highly specialized field that is in demand worldwide, creating opportunities for professionals to work in different countries and regions.

Prestige

quantitative finance is a highly respected profession that requires advanced education and specialized training.

Job satisfaction

The need for financial accounting is not limited to any specific industry, so there is always a high demand for qualified professionals.

Long hours

the work in quantitative finance can be demanding, requiring long hours and tight deadlines.

Stressful environment

the fast-paced and high-pressure environment of quantitative finance can be stressful.

Limited creativity

the work in quantitative finance is highly structured, with little room for creativity or independent decision-making.

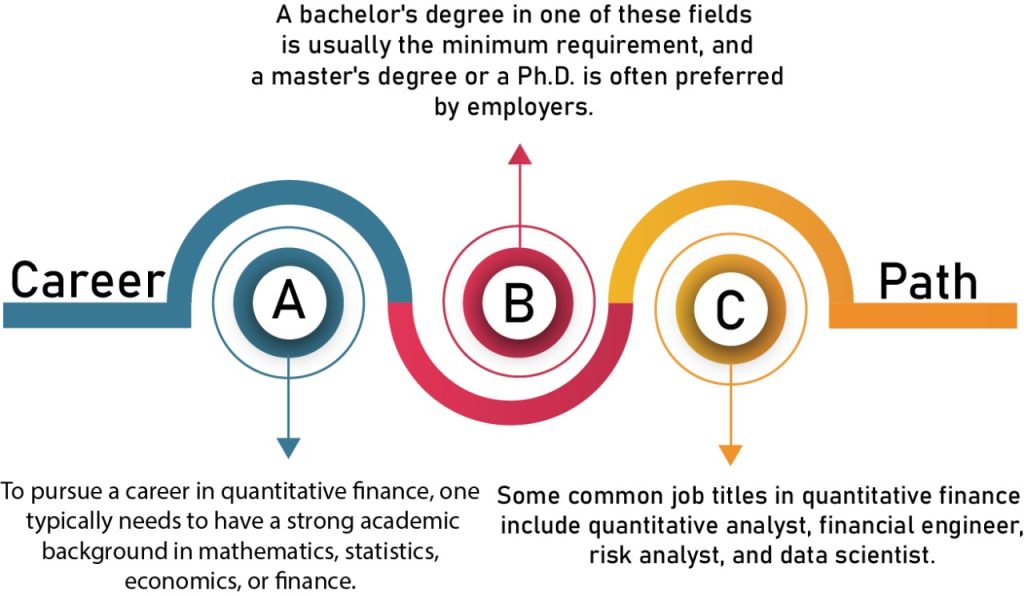

A career in quantitative finance can offer high earning potential, but it often requires a significant investment in education and training. Quantitative finance involves the use of mathematical and statistical models to analyze financial data and make investment decisions. To be successful in this field, individuals typically need a strong background in mathematics, programming, and finance.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

While salaries for quantitative finance professionals can be quite high, the competition for jobs can be intense, and the work can be demanding. Therefore, individuals interested in pursuing a career in quantitative finance should carefully consider the investment required in terms of education and training, as well as the potential earning opportunities and career growth prospects.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Advanced quantitative and analytical skills

Strong understanding of financial markets and instruments

Ability to identify and manage risks

Proficiency in programming languages and statistical analysis tools

Attention to detail and ability to work under pressure

Unable to handle high stress and long working hours

Lack of creativity and originality in some areas of the field.

Limited interpersonal skills and teamwork abilities in some cases

Tendency to rely too heavily on models and algorithms

Impatience or inability to work through complex problems.

Tendency to procrastinate or miss deadlines.

Work-life balance

Work-life balance can be a challenge in quantitative finance due to the demanding nature of the work. Long hours, tight deadlines, and high-pressure environments can make it difficult to maintain a healthy work-life balance.

But it’s important to keep in mind that finding a good work-life balance is key for our performance in the long run and general well-being.

Prioritizing our time and establishing reasonable expectations for ourselves will help us to keep this balance. Also, it is crucial to emphasise self-care, take pauses, and partake in extracurricular activities.

Quantitative finance can have a significant impact on the financial industry, particularly in the areas of risk management, portfolio optimization, and trading strategies.

By developing advanced mathematical models and using big data analytics, quantitative finance professionals can help to identify and mitigate risk, improve investment performance, and increase efficiency in financial markets.

Professionals in this field can help financial institutions make informed investment decisions, manage risk effectively, and improve overall financial performance.

Computer engineering has enabled advancements in fields such as healthcare, education, and communication, leading to better access to services and resources.

The increasing reliance on technology has led to concerns about privacy and security, leading to the need for stronger regulations and cybersecurity measures.

The development of automation and artificial intelligence may lead to job displacement and require reskilling for certain sectors.

Risk management

focuses on identifying and managing financial risks, such as credit, market, and operational risks.

Trading

involves developing and executing trading strategies in financial markets.

Portfolio management

focuses on managing investment portfolios to maximize returns and minimize risk.

Quantitative research

involves conducting research to identify trends and patterns in financial data.

Computer Networks

Focuses on designing, implementing, and maintaining computer networks that enable communication and data transfer between devices.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.