Financial planning is a rapidly growing and highly rewarding career option that involves helping individuals and businesses manage their finances and achieve their financial goals. Financial planners help clients create and implement strategies for saving, investing, budgeting, retirement planning, and risk management.

Financial planning can be an exciting and fulfilling career path for those who have a passion for finance, strong analytical skills, and a desire to help others achieve their financial goals.

Work description

The work of a financial planner can vary depending on their specialization and the needs of their clients. However, typical tasks may include:

- Meeting with clients to understand their financial situation, goals, and objectives

- Developing and implementing financial plans that align with clients’ goals

- Researching investment opportunities and making recommendations to clients

- Communicating with clients regularly to provide updates on their financial status and make adjustments as needed

Stable career path

Financial planning can provide a sense of security and peace of mind for clients.

Competitive salary

Financial planners have the opportunity to work with a variety of clients and help them achieve their goals.

Opportunities for growth

Financial planning is a growing industry, and there is high demand for qualified professionals.

Transferable skills

Financial planners have the potential to earn a good income.

high demand

Computer engineers may have the option to work remotely or on a flexible schedule, depending on the job and employer

Job satisfaction

The need for financial accounting is not limited to any specific industry, so there is always a high demand for qualified professionals.

High stress

Financial planning can be a highly regulated industry, which can create challenges for non -professionals.

Long hours

Financial planners must keep up with changes in tax laws, investment trends, and financial regulations, which can require significant time and effort.

Details oriented

Financial planning can be a stressful career, as clients’ financial situations can be complex and difficult to navigate.

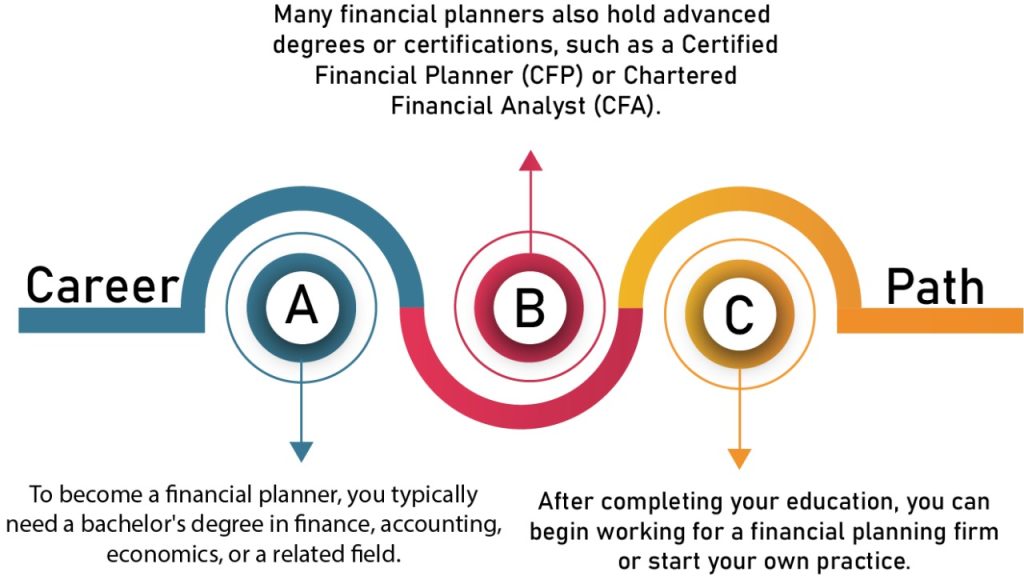

The investment required to become a financial planner in India depends on the education and certification path chosen by the individual. A bachelor’s degree in finance or economics typically costs between INR 50,000 to INR 5 lakhs, while a certification or diploma program in financial planning can cost between INR 50,000 to INR 1.5 lakhs. Obtaining a professional certification such as CFP can cost between INR 1-2 lakhs.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

The earning potential for financial planners in India can vary widely depending on their level of experience, specialization, and location. The average salary for a financial planner in India is around INR 400,000 per year. However, experienced financial planners with specialized expertise and a strong client base can earn significantly more.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Strong analytical skills

Excellent communication skills

Ability to build relationships with clients

Knowledge of financial regulations and investment strategies

A passion for helping people achieve their financial goals

May struggle with sales and marketing.

May struggle with managing stress.

A lack of technical knowledge or education in finance and accounting.

Difficulty building a client base and marketing their services.

Impatience or inability to work through complex problems.

Tendency to procrastinate or miss deadlines.

Work-life balance

Work-life balance can be a challenge for financial planners, especially those who are just starting out and building their client base. However, some financial planning firms offer flexible work arrangements, such as telecommuting and flexible scheduling, to help employees balance their work and personal lives. Additionally, financial planners who establish a strong client base may be able to set their own schedules and have more control over their workload.

Financial planning can have a significant impact on clients’ lives, helping them achieve their financial goals and providing them with a sense of security and peace of mind.

By creating a personalized financial plan, financial planners can help their clients save for retirement, manage their investments, and plan for major life events like buying a house or starting a business. They can also help clients manage their debt and reduce their financial stress, which can have a positive impact on their overall well-being.

Additionally, financial planners can play an important role in promoting financial literacy and helping clients make informed decisions about their money.

Computer engineering has enabled advancements in fields such as healthcare, education, and communication, leading to better access to services and resources.

The increasing reliance on technology has led to concerns about privacy and security, leading to the need for stronger regulations and cybersecurity measures.

The development of automation and artificial intelligence may lead to job displacement and require reskilling for certain sectors.

Retirement planning

Involves developing algorithms that enable machines to learn from data and make decisions without human intervention.

Investment management

Focuses on protecting computer systems, networks, and sensitive data from unauthorized access, attacks, and theft.

Tax planning

Involves designing, developing, and maintaining software applications and systems.

Estate planning

Involves processing, analyzing, and interpreting large and complex data sets using statistical and computational methods.

Computer Networks

Focuses on designing, implementing, and maintaining computer networks that enable communication and data transfer between devices.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.