Wealth management is the professional service of managing a client’s wealth by providing financial advice and investment management. Wealth managers work with high-net-worth individuals, families, and businesses to help them achieve their financial goals.

Work description

The work of a wealth manager involves providing financial advice and investment management services to high-net-worth clients.

They analyze clients’ financial situations, develop customized investment plans, and provide ongoing advice and guidance. Wealth managers also monitor and adjust investment portfolios to maximize returns and minimize risks.

Stable career path

High earning potential

Competitive salary

Opportunities for growth and advancement

Opportunities for growth

Opportunities to work with high-net-worth clients

Transferable skills

Work in a challenging and dynamic environment

high demand

Professional development opportunities

Job satisfaction

The need for financial accounting is not limited to any specific industry, so there is always a high demand for qualified professionals.

High stress

Requires a high level of education and certification

Long hours

Highly competitive industry

Details oriented

Long working hours and high stress levels

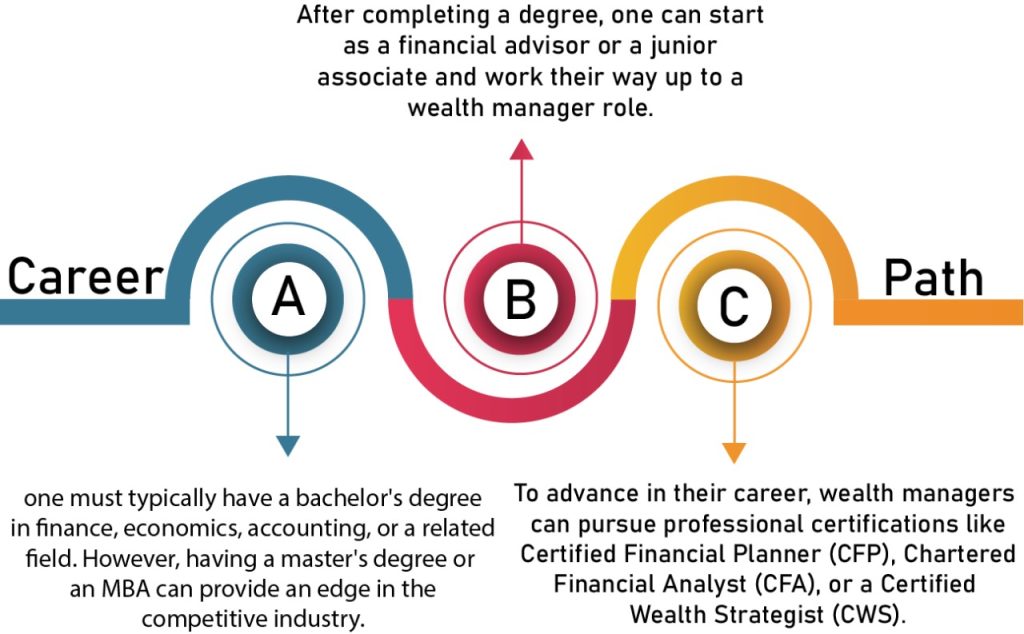

The investment required to become a wealth manager in India depends on the level of education and certification one wishes to pursue. A bachelor’s degree can cost around INR 5-10 lakhs, while an MBA can cost up to INR 20 lakhs or more. The cost of obtaining a professional certification can range from INR 50,000 to INR 3 lakhs.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

The earning potential of wealth managers in India is high, and it varies depending on factors such as education, experience, location, and client base. Entry-level wealth managers can earn around INR 5-8 lakhs per annum, while experienced and top-performing wealth managers can earn more than INR 50 lakhs per annum.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Strong analytical skills

Excellent communication skills

Good interpersonal skills

Ability to work in a team

Strong work ethics

Lack of attention to detail

Poor communication skills

Unethical behavior

Lack of empathy towards clients

Impatience or inability to work through complex problems.

Tendency to procrastinate or miss deadlines.

Work-life balance

The work-life balance of a wealth manager can be challenging due to long working hours and high-stress levels. To achieve it, it is important to set boundaries between work and personal life, prioritize your workload, take breaks, use vacation time, communicate with your employer, and prioritize your well-being. Taking time off can help you come back to work feeling refreshed and energized, and prioritizing your workload can help you achieve a healthy balance between your career in wealth management and your personal life.

The impact of wealth management on a country can be significant. Wealth managers play a crucial role in managing the assets of high-net-worth individuals and families, which can have a positive impact on the economy.

They also contribute to job creation, as the industry requires skilled professionals to provide services to clients.

The increasing demand for computer engineers has led to job creation and economic growth in various countries, including India.

Computer engineering has enabled advancements in fields such as healthcare, education, and communication, leading to better access to services and resources.

The increasing reliance on technology has led to concerns about privacy and security, leading to the need for stronger regulations and cybersecurity measures.

The development of automation and artificial intelligence may lead to job displacement and require reskilling for certain sectors.

Investment management

This specialization focuses on managing investment portfolios for clients and maximizing their returns.

Retirement planning

It focuses on helping clients plan for their retirement by developing strategies to maximize retirement income and minimize taxes.

Tax planning

It involves developing strategies to minimize the tax burden on clients’ investment portfolios and overall financial situation.

Estate planning

It involves developing strategies to manage the transfer of wealth from one generation to the next, while minimizing taxes and ensuring that the clients’ wishes are met.

Computer Networks

Focuses on designing, implementing, and maintaining computer networks that enable communication and data transfer between devices.

Conclusion:

These are just some of the specializations within the field of wealth management. As the needs of high net worth individuals and families continue to evolve, new specializations may emerge to meet those needs.