Corporate banking is a specialized banking field that deals with providing financial services to large corporations, governments, and other financial institutions. It involves various activities like corporate lending, cash management, trade finance, and treasury services. A career in corporate banking can be rewarding but also requires a particular skill set and expertise.

Work description

The work of a corporate banker includes:

- managing client relationships

- analyzing financial statements

- assessing credit risks

- developing strategies to increase the bank’s revenue

- ensure compliance with regulatory requirements and maintain strong working relationships with other departments of the bank.

High earning potential

Corporate bankers are among the highest-paid professionals in the banking industry.

Career growth opportunities

Corporate banking offers ample opportunities for career growth and advancement.

Challenging work

Corporate bankers deal with complex financial transactions, which makes the work challenging and exciting.

Networking opportunities

Corporate bankers interact with top-level executives of large corporations, which provides ample networking opportunities.

Prestige

Corporate bankers are highly respected in the financial industry.

Job satisfaction

The need for financial accounting is not limited to any specific industry, so there is always a high demand for qualified professionals.

Long working hours

Corporate bankers often work long hours, including weekends and holidays.

High-pressure environment

The work environment in corporate banking is highly competitive, which can be stressful.

Tight deadlines

Corporate bankers are often required to meet tight deadlines, which can cause work-related stress.

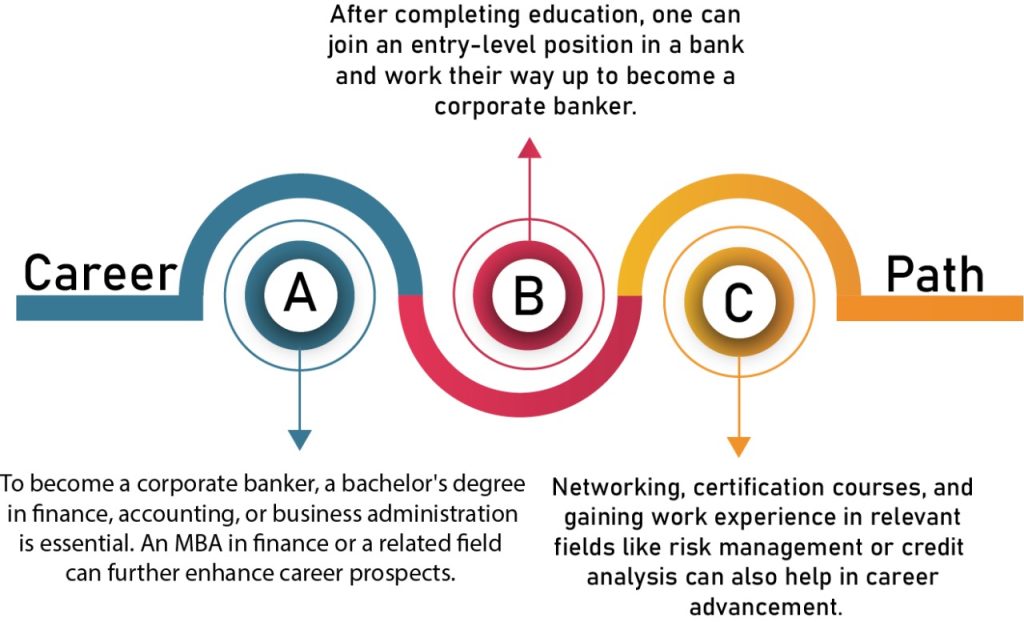

Investment in a career in corporate

banking includes educational qualifications, certifications, and networking.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

The earning potential in India for corporate bankers is high, with salaries ranging from INR 5-10 lakhs per annum for entry-level positions and INR 25-30 lakhs per annum for mid to senior-level positions.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Analyze financial statements and assess credit risks.

Relationship-building abilities

Ability to work as a team

Excellent communication skills

Good communication and teamwork skills

Not willing to put in the effort and lacks the motivation to succeed.

Only concerned with short-term gains

Lacks the ability to see the big picture

Lack of interpersonal skillsc

Impatience or inability to work through complex problems.

Tendency to procrastinate or miss deadlines.

Work-life balance

Due to the pressure to meet goals and deadlines, corporate banking is a difficult profession that frequently necessitates working weekends.

Employees should prioritize their personal lives and welfare by setting limits, using time management strategies, and taking breaks in order to achieve work-life balance in corporate banking. This can involve scheduling time for socializing, hobbies, and exercise, putting restrictions on business-related communication after hours, and employing time-management strategies like the Pomodoro technique.

In the end, striking a work-life balance is essential for advancing in corporate banking since it increases output, boosts job satisfaction, and lowers turnover rates.

Corporate banking plays a vital role in the country’s economy by providing financing to large corporations and other financial institutions.

A strong corporate banking sector can contribute to economic growth and stability by supporting businesses’ expansion and creating job opportunities.

Corporate banks also play a crucial role in managing the country’s financial risks and ensuring compliance with regulatory requirements.

Computer engineering has enabled advancements in fields such as healthcare, education, and communication, leading to better access to services and resources.

The increasing reliance on technology has led to concerns about privacy and security, leading to the need for stronger regulations and cybersecurity measures.

The development of automation and artificial intelligence may lead to job displacement and require reskilling for certain sectors.

Credit Analysis

Credit analysts are responsible for evaluating the creditworthiness of potential borrowers and assessing the risks associated with lending money.

Investment Banking

Investment bankers help companies raise capital by issuing stocks and bonds, underwriting securities, and providing financial advisory services.

Relationship Management

Relationship managers are responsible for building and maintaining relationships with clients, understanding their financial needs, and developing customized solutions to meet those needs.

Risk Management

: Risk managers are responsible for identifying, assessing, and mitigating risks that could impact the bank’s financial stability. They analyze market trends, monitor credit and market risks, and develop risk management strategies.

Computer Networks

Focuses on designing, implementing, and maintaining computer networks that enable communication and data transfer between devices.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.