Insurance underwriting is the process of evaluating and assessing the risk associated with an insurance policy. It involves analyzing the potential policyholder’s application, assessing the risk of insuring that individual or entity, and deciding whether to approve or deny the application for coverage. Based on their assessment of the risks involved, underwriters will determine the premium to be charged for the policy. If they determine that the risk is too high, they may decline to offer coverage or may charge a higher premium to compensate for the added risk.

Work description

Insurance underwriters are responsible for evaluating and assessing the risk associated with insuring individuals, businesses, and other entities. They work for insurance companies and use their expertise to analyze insurance applications, determine the level of risk involved, and decide whether to approve or deny the application for coverage.

Underwriters carefully review each application to determine the level of risk involved. They examine a variety of factors, such as the applicant’s health, age, occupation, and past insurance history.

Once they have assessed the level of risk, underwriters will determine the premium to be charged for the policy. They use actuarial tables and other data to help them calculate the appropriate premium.

Underwriters must make sure that the insurance company is not taking on too much risk. They may set limits on the amount of coverage offered or require certain conditions to be met before approving an application.

Underwriters must stay informed about changes in the insurance industry and new products and services being offered. This helps them make informed decisions and provide the best possible service to customers.

High Demand

Challenging and intellectually stimulating work.

Lucrative salaries

Good salary and benefits.

Opportunities for innovation

Opportunities for advancement and specialization.

Versatility

Opportunities to work in a variety of industries.

Flexibility

High job security.

High stress

Can be stressful, with high-pressure deadlines and demanding workload.

Long hours

Requires attention to detail and accuracy.

Competitive field

Can involve making difficult decisions that impact people’s lives.

Constant learning

Limited opportunities for creativity or innovation in some roles.

Isolation

Can require long hours or occasional travel.

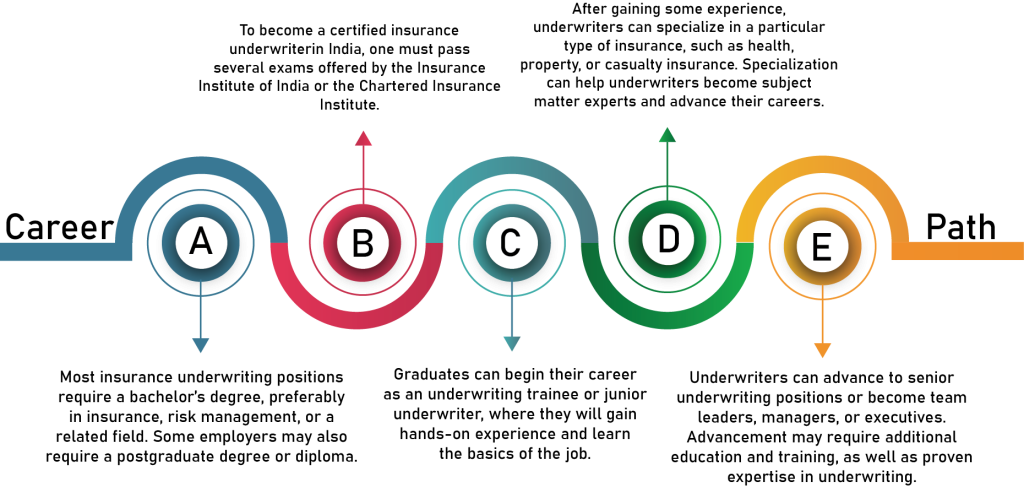

The cost of pursuing a career in insurance underwriting in India will vary depending on several factors, such as the level of education and training required, the institution chosen, and the location of the program.

A bachelor’s degree in insurance, risk management, or a related field typically costs between INR 5-15 lakhs, while a postgraduate degree or diploma can cost INR 2-10 lakhs.

Professional certifications, such as those offered by the Insurance Institute of India or the Chartered Insurance Institute, can cost several thousand rupees to obtain.

Underwriters must pass several exams to become certified, which can cost several thousand rupees per exam. Other expenses may include books and study materials, transportation, and living expenses.

Overall, the cost of pursuing a career in insurance underwriting in India can range from INR 5 lakhs to upwards of INR 20 lakhs, depending on the level of education and training required.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”true” titles=”2 year , 5 year” values=”3,7,5,12″]

The earning potential of an insurance underwriter in India varies depending on several factors, such as their level of experience, the type of insurance they specialize in, and the company they work for.

Entry-level underwriters can expect to earn between INR 3-6 lakhs per year.

Mid-level underwriters with several years of experience can earn between INR 8-15 lakhs per year.

Senior-level underwriters with extensive experience and specialized expertise can earn upwards of INR 20 lakhs per year.

Earning potential can also vary depending on the type of insurance underwriting.

[wpcharts type=”horizontalbarchart” bgcolor=”red:gray:yellow,blue:gray:yellow,random:gray:yellow,purple:gray:yellow” min=”0″ legend=”false” titles=”Entry-Level, Mid-Career, Senior-Level ” values=”5,15,25,35,45,55″]

Strong analytical and critical thinking skills.

Attention to detail and accuracy.

Strong communication and interpersonal skills.

Ability to work well under pressure and meet deadlines.

Aptitude for problem-solving and decision-making.

Ability to work independently and as part of a team.

Interest in the insurance industry and risk management.

Poor attention to detail or lack of accuracy.

Difficulty with critical thinking and problem-solving.

Poor communication or interpersonal skills.

Inability to handle stress or work under pressure.

Lack of interest in the insurance industry or risk management.

Difficulty working independently or as part of a team.

Work-life balance

The work-life balance of an insurance underwriter can vary depending on several factors, such as their employer, workload, and specialization.

Insurance underwriters typically work standard business hours, although some may need to work overtime to meet deadlines or during peak periods.

The workload of an insurance underwriter can vary depending on the volume of policies and claims they are responsible for. Underwriters may need to work longer hours or on weekends during busy periods.

Some insurance companies offer flexible work arrangements, such as telecommuting or flexible hours, to help employees balance work and personal commitments.

Insurance underwriting can be a high-pressure job, as underwriters are responsible for making important decisions that can affect the company’s bottom line. However, stress levels can vary depending on the individual and the work environment.

Provides stable employment with opportunities for career advancement and growth.

Offers a competitive salary and benefits package.

Helps individuals develop analytical and critical thinking skills.

Allows individuals to become subject matter experts in a specific area of insurance.

Plays a crucial role in the insurance industry by managing risk and protecting individuals and businesses from financial losses.

Property and Casualty Underwriting

This specialization involves assessing risks and pricing policies for property and casualty insurance, such as home, auto, and liability insurance.

Life and Health Underwriting

This specialization involves evaluating risks and pricing policies for life and health insurance, including assessing factors such as age, health, and medical history.

Commercial Underwriting

This specialization involves evaluating risks and pricing policies for businesses, such as general liability, workers’ compensation, and property insurance.

Conclusion:

In Conclusion, pursuing a Career in Computer Engineering in India requires a Strong Foundation in math and science, a passion for technology, and a willingness to continuously learn and adapt to New Developments in the industry. With competitive salaries, opportunities for career growth, and the potential to make a significant impact on society, computer engineering can be a Rewarding and Fulfilling Career choice for those who are up for the challenge.